VERTEX

PORTFOLIO MANAGEMENT

The goal of portfolio management is to ensure that all contractual obligations are realized at the estimated costs (or less), within the risk framework.

To ensure a good oversight of the different positions at different levels and stages, the contracts and (connected) deals are submitted into two types of books:

VERTEX

Portfolio Management

VERTEX

Sales Books

VERTEX

Hedge Books

Sales Books

Fixed price sales book

The click contracts

The combi sales book

Different views of customer portfolios

The sum of all contracts

Portfolio Management

Hedge Books – trade console

The trade console shows all open tradable positions in the hedge book. The portfolio manager immediately receives an overview of all products that can be traded in order to close the open positions (as much as possible).

The trade console provides the most suitable hedge proposal, based on the available trading products*, resulting in the smallest possible open (residual) position

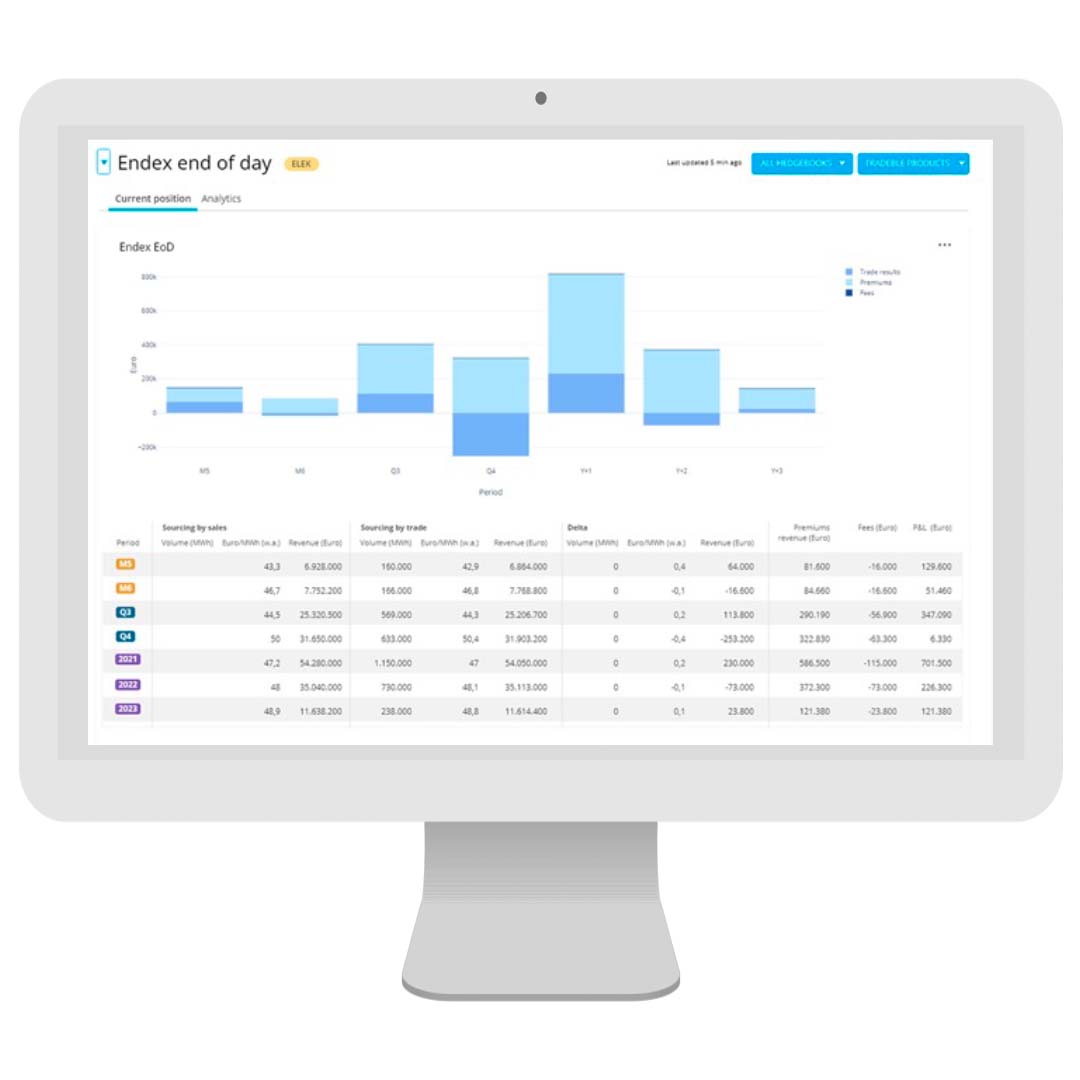

Endex end of Day

The trade console

The trade console shows all open tradable positions in the hedge book. The portfolio manager immediately receives an overview of all products that can be traded in order to close the open positions (as much as possible).

The trade console provides the most suitable hedge proposal, based on the available trading products*, resulting in the smallest possible open (residual) position.

Volume, revenue and P&L

Total of all positions (Volume, revenue and P&L) in the hedge portfolios for the total electricity portfolio, consisting of:

- Fixed volume (hedged by customer and supplier).

- Open position Exposed: volumes fixed by the customer, but not yet purchased by the supplier (price risk)

- Open position Forward*: Volumes from click contracts to be fixed by the customer (and supplier)

- Open position Combi*: Volumes from combi contracts to be fixed by the customer (and supplier).

- Spot rest. The volume neutral rest volumes (balance at monthly level).

An estimate of the potential loss

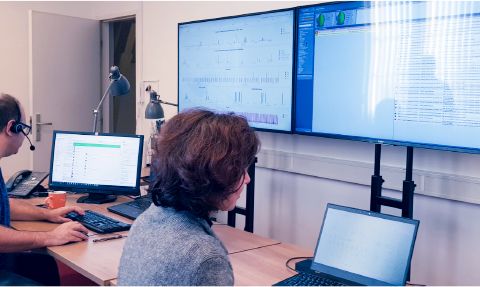

Monitoring activities on streaming data

7-23, 7 days a week monitoring & operational follow up.

Choose the right solution for your business needs

VERTEX applicable to all major Energy companies

Lead management

Pricing management

CONTRACT MANAGEMENT

Day- ahead

Intraday- module

BRP management

Maintain supply and demand on the energy market

Balancing Services

Document Generation

A smart solution that revolutionizes document layout and management